PLATINUM QUARTERLY- Q4 2020

2020第四季世界鉑金報告(擷取)

WPIC,10th March 2021

Platinum supply and demand – updating 2020 and 2021 forecasts

鉑金供求–更新2020年和2021年的預測

In 2020 the platinum market was in a deficit of -932 koz, the largest annual deficit on record albeit below the -1,202 koz deficit forecast in November 2020. This difference was due to Anglo American Platinum Converter Plant (ACP) Phase A being restarted in December 2020, three weeks earlier than expected. However, over the year, as a whole, lower supply due to COVID-19-related mine closures, ACP outages and reduced recycling far outweighed the pandemic-driven fall in demand from the automotive, jewellery and industrial sectors, which fall was partially offset by increased investment demand.

2020年,鉑金市場的赤字為-932千盎司**,是有記錄以來的最大年度赤字,儘管低於2020年11月的預測赤字-1,202千盎司。 2020年12月,比預期提前三週。但是,在整個一年中,與COVID-19相關的礦山關閉,ACP停運和減少的回收利用導致的供應減少,遠遠超過了由COVID19流行病驅動的汽車,珠寶和工業部門的需求下降,但這一下降被部分抵消了通過增加投資需求。

**koz = 千盎司 = 1000盎司**

For 2021 the platinum market is forecast to remain in a deficit for the third consecutive year. The modest deficit of -60 koz results from a 17% increase in total supply and a 3% increase in total demand. Interestingly, total supply in 2021 will still be 3% lower than in 2019, with industrial, jewellery and automotive demand levels all above their respective levels in 2019.

預計到2021年,鉑金市場將連續第三年保持短缺。總供應量增加17%,總需求增加3%,導致-60千盎司赤字適度。有趣的是,2021年的總供應量仍將比2019年低3%,工業,珠寶和汽車的需求水平都將高於2019年的水平。

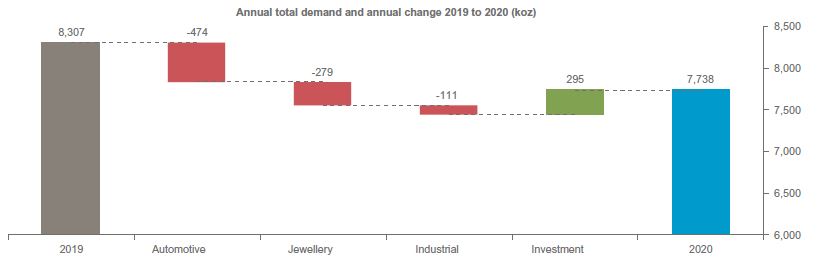

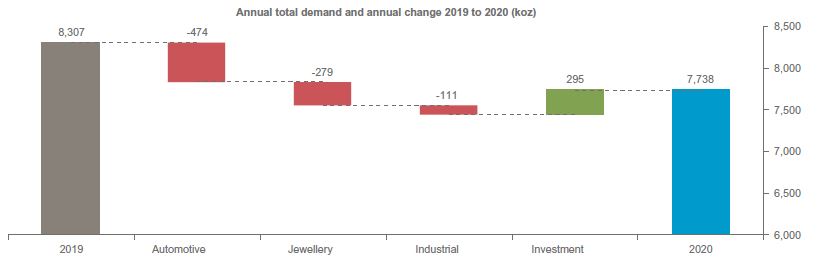

Total platinum demand in 2020 was 7,738 koz, 7% (-569 koz) lower than in 2019. Automotive demand reduced by 17% (-474 koz) year-on-year, largely due to lower vehicle sales in the first half of the year, as measures to control the spread of COVID-19 resulted in vehicle factory and showroom closures. However, platinum automotive demand losses were cushioned by the impact of higher metal loadings on catalysts to meet tighter emissions regulations. Jewellery demand was similarly impacted in 2020, with volumes 13% (-279 koz) lower on a full-year basis despite quarter four demand returning to pre-pandemic levels. Industrial demand was

5% (-111 koz) lower, with strong glass sector demand largely compensating for weakness in all other industrial demand segments.

2020年鉑金總需求為7,738千盎司,比2019年下降7%(-569千盎司)。汽車需求同比下降了17%(-474千盎司),主要是由於上半年汽車銷量下降去年,由於控制COVID-19傳播的措施導致車輛工廠和陳列室關閉。然而,鉑金汽車需求損失因較高的金屬負載量對催化劑的影響而得到緩解,以滿足更嚴格的排放法規。珠寶需求在2020年也受到了類似的影響,儘管第四季度需求回到了大流行前的水平,但全年銷量卻下降了13%(-279 千盎司)。工業需求為玻璃行業的強勁需求在很大程度上彌補了所有其他工業需求領域的疲軟,因此下降了5%(-111 千盎司)。

In 2020, weakness in automotive, jewellery and industrial demand was partly offset by strong investment demand, from bars and coins and ETFs, collectively up 24% (+295 koz) year-on-year. Heightened global risk drove investor demand for hard assets such as platinum during the first half of the year, further encouraged by the weak platinum price. Investment demand increased in line with the improving economic outlook in the second half of 2020 and was bolstered by NYMEX futures exchange physical metal stocks, that increased significantly to address the disconnect between the price of platinum futures and platinum. However, as the year progressed bar and coin demand moderated somewhat as the platinum price increased and stock shortages in North America were addressed. ETF holdings increased strongly over the year with growth in North America, Europe and Japan far exceeding declines in South Africa.

2020年,汽車,珠寶和工業需求的疲軟被金條,硬幣和ETF的強勁投資需求部分抵消,總體同比增長24%(+295千盎司)。由於鉑金價格疲軟,在上半年,全球風險加劇,帶動了投資者對諸如鉑金等硬資產的需求。隨著2020年下半年經濟前景改善,投資需求有所增加,並且受到紐約商品交易所期貨交易所實物金屬股票的支撐,該需求顯著增加以解決鉑金期貨和鉑金價格之間的脫節。然而,隨著這一年的發展,白金和鉑金價格的上漲使得金條和金幣的需求有所緩和,北美的庫存短缺得到了解決。 ETF持有量在過去一年中強勁增長,北美,歐洲和日本的增長遠超過南非的下降。

Total platinum supply in 2020 was 17% (-1,413 koz) lower at 6,806 koz due to a 18% (-1,126 koz) decline in refined production and a 10% (-210 koz) decline in recycling supply. South African refined supply was 26% (-1,133 koz) lower due to COVID-19-driven mine closures and the ACP outages in March and November.

2020年鉑金總供應量下降17%(-1,413千盎司),至6,806千盎司,這是由於精煉生產下降18%(-1,126千盎司)和回收供應下降10%(-210千盎司)。南非精煉供應量減少26%(-1,133千盎司),這是由於COVID-19驅動的礦山關閉以及3月和11月ACP停運。

2020 FOURTH QUARTER PLATINUM MARKET REVIEW

2020年第四季度鉑金市場評論

The positive momentum in global economic recovery seen in Q3’20 continued in Q4’20, supported by vaccination availability but hampered somewhat by renewed waves of infection and new variants of the virus. This had varied impacts on platinum’s supply and demand segments and resulted in a platinum deficit for a third consecutive quarter.

在20季度第20季度,全球經濟復甦的積極勢頭在20季度第4季度繼續,這得益於接種疫苗的支持,但又受到新一波的感染浪潮和新病毒變種的阻礙。這對鉑金的供需領域產生了不同的影響,並導致鉑金連續第三季度出現短缺。

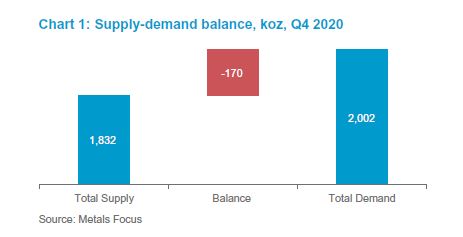

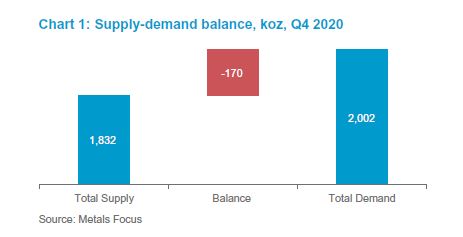

Compared to Q4’19 platinum supply was 15% (-326 koz) lower as the 8% (+45 koz) higher recycling was unable to counter the 23% (-371 koz) decline in mining supply. Total platinum demand was 2,002 koz, 18% (+299 koz) higher than Q4’19.

與19年第4季度相比,鉑金供應量減少了15%(-326千盎司),因為回收率提高了8%(+45千盎司)無法抵消採礦供應量下降23%(-371千盎司)的影響。鉑金總需求量為2,002千盎司,比19年第4季度高18%(+299千盎司)。

Automotive demand rose by 5% (+31 koz) year-on-year, while jewellery demand was up 7% (+32 koz). The 43% (+184 koz) rise in industrial demand during Q4’20 was mostly due to a swing in the glass sector from negative demand in Q4’19, to positive in Q4’20. In turn, this reflected furnace decommissioning in Q4’19 and capacity expansions in Q4’20. Although platinum demand in the remaining segments of industrial demand increased compared to Q3’20, it was lower than Q4’19 levels.

汽車需求同比增長5%(+31千盎司),而珠寶需求增長7%(+32千盎司)。 20季度第4季度工業需求增長了43%(+184千盎司),主要是由於玻璃行業從19季度第4季度的負需求到20季度第4季度的正增長。反過來,這反映了19季度第4季度爐子的退役和20季度第4季度產能的擴大。儘管剩餘鉑金需求與20季度第3季度相比,工業需求增長了,但低於19季度第4季度的水平。

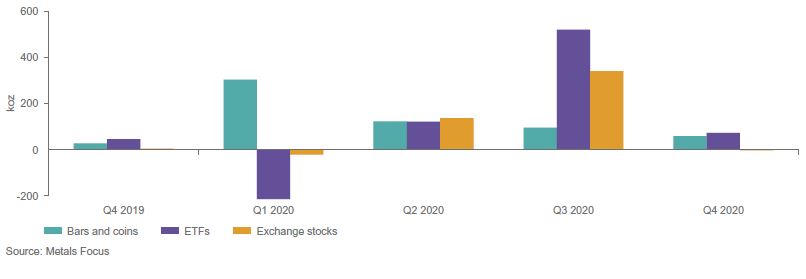

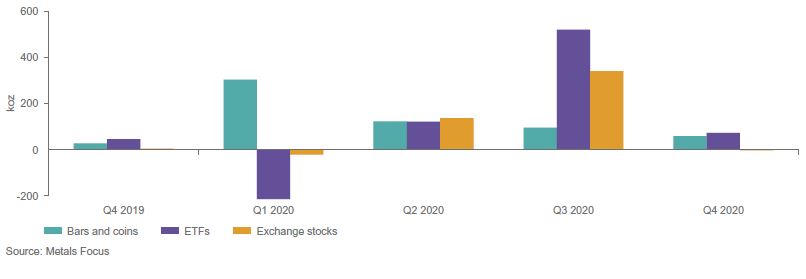

In Q4’20 investment demand was 63% (+51 koz) higher than Q4’19 despite being 86% (-827 koz) lower than the highest on record level in Q3’20. Bar and coin net purchases more than doubled year-on-year, growing 112% (+32 koz) while ETF holdings added 74 koz during the quarter, up 56% on last year. Platinum stocks held by exchanges declined by less than 1 koz in Q4’20 compared to the increase of 6 koz in Q4’19. This followed two exceptional quarters, Q2’20 and Q3’20, when NYMEX inventories increased by 138 koz and 342 koz respectively.

在20年第4季度,投資需求比19年第4季度高63%(+51千盎司),儘管比20季度第3季度的歷史最高水平低86%(-827千盎司)。金條和金幣的淨購買量同比增長了一倍以上,增長了112%(+ 32千盎司),而ETF持倉量在本季度增加了74千盎司,比去年同期增長了56%。交易所持有的鉑金股票在20年第四季度下降了不到1盎司,而在19年第四季度增長了6千盎司。在此之後的兩個季度,即第二季度20和第三季度20,紐約商品交易所的庫存分別增加了138千盎司和342千盎司。

The platinum deficit in Q4’20 of -170 koz contrasts with the large surplus in Q4’19 (+455 koz) and the particularly large deficit in Q3’20 (-756 koz). These fluctuations reflect the significant impact of mainly pandemic-related changes in 2020 on mine supply and demand from industrial uses and investment.

20年第4季度的鉑金短缺為-170千盎司,而19年第4季度的大量盈餘(+455千盎司)與20年第3季度的特別盈餘(-756千盎司)形成鮮明對比。這些波動反映出2020年主要與大流行有關的變化對礦山供需的工業用途和投資產生了重大影響。

Investment demand

投資需求

During Q4’20, global bar and coin demand more than doubled year-on-year to 60 koz. The strength reflected a much-improved demand in North America, while net sales in Japan and Europe were little changed compared with Q4’19. However, buying was sharply weaker quarter-on-quarter, falling by 38% as a result of Japan swinging from modest net investment during the July to September period to modest net selling in the fourth quarter.

在20年第四季度,全球金條和金幣的需求量同比增長了一倍以上,達到60千盎司。強勁的表現反映出北美需求大大改善,而與19年度第4季度相比,日本和歐洲的淨銷售額變化不大。然而,由於日本從7月至9月的適度淨投資轉為第四季度的適度淨賣出,購買量環比急劇下降,下降了38%。

In North America, the market has effectively recovered from the pandemic-induced shortages which affected Q2’20. In particular, the availability of 1 oz small bars has returned to more normal levels over the past 4-5 months, although retail premiums have often remained above pre-pandemic levels.在北美,市場已有效地從大流行引起的短缺中恢復過來,短缺影響了20年代第二季度。特別是,在過去的4-5個月中,1盎司小條的可用性已恢復到更正常的水平,儘管零售溢價通常仍保持在大流行前的水平之上。

After two strong quarters ETF inflows slowed during October and November but recovered in December to post a net increase in holdings 56% (+26 koz) above Q4’19. At the end of December, ETF holdings were at an all-time high of 3,881 koz. Exchange stocks reduced by around 1 koz and ended the year at a historical high of 657 koz, due to the unusual and unprecedented increase in NYMEX approved warehouse stocks in 2020.

在經歷了兩個強勁的季度之後,ETF的流入量在10月和11月有所放緩,但在12月有所恢復,持有量比19年第4季度淨增加56%(+ 26千盎司)。截至12月底,ETF持有量達到3,881千盎司的歷史新高。由於2020年NYMEX批准的倉庫庫存異常而空前的增加,交易所的庫存減少了約1千盎司,並在年底達到了657千盎司的歷史最高水平。

Chart 4: Platinum Investment, koz

圖4:鉑金投資,單位:千盎司

Shiny黃金白銀交易所

引用來源: 部分擷取 WPIC, PLATINUM QUARTERLY- Q4 2020PLATINUM QUARTERLY- Q4 2020

2020第四季世界鉑金報告(擷取)

WPIC,10th March 2021

Platinum supply and demand – updating 2020 and 2021 forecasts

鉑金供求–更新2020年和2021年的預測

In 2020 the platinum market was in a deficit of -932 koz, the largest annual deficit on record albeit below the -1,202 koz deficit forecast in November 2020. This difference was due to Anglo American Platinum Converter Plant (ACP) Phase A being restarted in December 2020, three weeks earlier than expected. However, over the year, as a whole, lower supply due to COVID-19-related mine closures, ACP outages and reduced recycling far outweighed the pandemic-driven fall in demand from the automotive, jewellery and industrial sectors, which fall was partially offset by increased investment demand.

2020年,鉑金市場的赤字為-932千盎司**,是有記錄以來的最大年度赤字,儘管低於2020年11月的預測赤字-1,202千盎司。 2020年12月,比預期提前三週。但是,在整個一年中,與COVID-19相關的礦山關閉,ACP停運和減少的回收利用導致的供應減少,遠遠超過了由COVID19流行病驅動的汽車,珠寶和工業部門的需求下降,但這一下降被部分抵消了通過增加投資需求。

**koz = 千盎司 = 1000盎司**

For 2021 the platinum market is forecast to remain in a deficit for the third consecutive year. The modest deficit of -60 koz results from a 17% increase in total supply and a 3% increase in total demand. Interestingly, total supply in 2021 will still be 3% lower than in 2019, with industrial, jewellery and automotive demand levels all above their respective levels in 2019.

預計到2021年,鉑金市場將連續第三年保持短缺。總供應量增加17%,總需求增加3%,導致-60千盎司赤字適度。有趣的是,2021年的總供應量仍將比2019年低3%,工業,珠寶和汽車的需求水平都將高於2019年的水平。

Total platinum demand in 2020 was 7,738 koz, 7% (-569 koz) lower than in 2019. Automotive demand reduced by 17% (-474 koz) year-on-year, largely due to lower vehicle sales in the first half of the year, as measures to control the spread of COVID-19 resulted in vehicle factory and showroom closures. However, platinum automotive demand losses were cushioned by the impact of higher metal loadings on catalysts to meet tighter emissions regulations. Jewellery demand was similarly impacted in 2020, with volumes 13% (-279 koz) lower on a full-year basis despite quarter four demand returning to pre-pandemic levels. Industrial demand was

5% (-111 koz) lower, with strong glass sector demand largely compensating for weakness in all other industrial demand segments.

2020年鉑金總需求為7,738千盎司,比2019年下降7%(-569千盎司)。汽車需求同比下降了17%(-474千盎司),主要是由於上半年汽車銷量下降去年,由於控制COVID-19傳播的措施導致車輛工廠和陳列室關閉。然而,鉑金汽車需求損失因較高的金屬負載量對催化劑的影響而得到緩解,以滿足更嚴格的排放法規。珠寶需求在2020年也受到了類似的影響,儘管第四季度需求回到了大流行前的水平,但全年銷量卻下降了13%(-279 千盎司)。工業需求為玻璃行業的強勁需求在很大程度上彌補了所有其他工業需求領域的疲軟,因此下降了5%(-111 千盎司)。

In 2020, weakness in automotive, jewellery and industrial demand was partly offset by strong investment demand, from bars and coins and ETFs, collectively up 24% (+295 koz) year-on-year. Heightened global risk drove investor demand for hard assets such as platinum during the first half of the year, further encouraged by the weak platinum price. Investment demand increased in line with the improving economic outlook in the second half of 2020 and was bolstered by NYMEX futures exchange physical metal stocks, that increased significantly to address the disconnect between the price of platinum futures and platinum. However, as the year progressed bar and coin demand moderated somewhat as the platinum price increased and stock shortages in North America were addressed. ETF holdings increased strongly over the year with growth in North America, Europe and Japan far exceeding declines in South Africa.

2020年,汽車,珠寶和工業需求的疲軟被金條,硬幣和ETF的強勁投資需求部分抵消,總體同比增長24%(+295千盎司)。由於鉑金價格疲軟,在上半年,全球風險加劇,帶動了投資者對諸如鉑金等硬資產的需求。隨著2020年下半年經濟前景改善,投資需求有所增加,並且受到紐約商品交易所期貨交易所實物金屬股票的支撐,該需求顯著增加以解決鉑金期貨和鉑金價格之間的脫節。然而,隨著這一年的發展,白金和鉑金價格的上漲使得金條和金幣的需求有所緩和,北美的庫存短缺得到了解決。 ETF持有量在過去一年中強勁增長,北美,歐洲和日本的增長遠超過南非的下降。

Total platinum supply in 2020 was 17% (-1,413 koz) lower at 6,806 koz due to a 18% (-1,126 koz) decline in refined production and a 10% (-210 koz) decline in recycling supply. South African refined supply was 26% (-1,133 koz) lower due to COVID-19-driven mine closures and the ACP outages in March and November.

2020年鉑金總供應量下降17%(-1,413千盎司),至6,806千盎司,這是由於精煉生產下降18%(-1,126千盎司)和回收供應下降10%(-210千盎司)。南非精煉供應量減少26%(-1,133千盎司),這是由於COVID-19驅動的礦山關閉以及3月和11月ACP停運。

2020 FOURTH QUARTER PLATINUM MARKET REVIEW

2020年第四季度鉑金市場評論

The positive momentum in global economic recovery seen in Q3’20 continued in Q4’20, supported by vaccination availability but hampered somewhat by renewed waves of infection and new variants of the virus. This had varied impacts on platinum’s supply and demand segments and resulted in a platinum deficit for a third consecutive quarter.

在20季度第20季度,全球經濟復甦的積極勢頭在20季度第4季度繼續,這得益於接種疫苗的支持,但又受到新一波的感染浪潮和新病毒變種的阻礙。這對鉑金的供需領域產生了不同的影響,並導致鉑金連續第三季度出現短缺。

Compared to Q4’19 platinum supply was 15% (-326 koz) lower as the 8% (+45 koz) higher recycling was unable to counter the 23% (-371 koz) decline in mining supply. Total platinum demand was 2,002 koz, 18% (+299 koz) higher than Q4’19.

與19年第4季度相比,鉑金供應量減少了15%(-326千盎司),因為回收率提高了8%(+45千盎司)無法抵消採礦供應量下降23%(-371千盎司)的影響。鉑金總需求量為2,002千盎司,比19年第4季度高18%(+299千盎司)。

Automotive demand rose by 5% (+31 koz) year-on-year, while jewellery demand was up 7% (+32 koz). The 43% (+184 koz) rise in industrial demand during Q4’20 was mostly due to a swing in the glass sector from negative demand in Q4’19, to positive in Q4’20. In turn, this reflected furnace decommissioning in Q4’19 and capacity expansions in Q4’20. Although platinum demand in the remaining segments of industrial demand increased compared to Q3’20, it was lower than Q4’19 levels.

汽車需求同比增長5%(+31千盎司),而珠寶需求增長7%(+32千盎司)。 20季度第4季度工業需求增長了43%(+184千盎司),主要是由於玻璃行業從19季度第4季度的負需求到20季度第4季度的正增長。反過來,這反映了19季度第4季度爐子的退役和20季度第4季度產能的擴大。儘管剩餘鉑金需求與20季度第3季度相比,工業需求增長了,但低於19季度第4季度的水平。

In Q4’20 investment demand was 63% (+51 koz) higher than Q4’19 despite being 86% (-827 koz) lower than the highest on record level in Q3’20. Bar and coin net purchases more than doubled year-on-year, growing 112% (+32 koz) while ETF holdings added 74 koz during the quarter, up 56% on last year. Platinum stocks held by exchanges declined by less than 1 koz in Q4’20 compared to the increase of 6 koz in Q4’19. This followed two exceptional quarters, Q2’20 and Q3’20, when NYMEX inventories increased by 138 koz and 342 koz respectively.

在20年第4季度,投資需求比19年第4季度高63%(+51千盎司),儘管比20季度第3季度的歷史最高水平低86%(-827千盎司)。金條和金幣的淨購買量同比增長了一倍以上,增長了112%(+ 32千盎司),而ETF持倉量在本季度增加了74千盎司,比去年同期增長了56%。交易所持有的鉑金股票在20年第四季度下降了不到1盎司,而在19年第四季度增長了6千盎司。在此之後的兩個季度,即第二季度20和第三季度20,紐約商品交易所的庫存分別增加了138千盎司和342千盎司。

The platinum deficit in Q4’20 of -170 koz contrasts with the large surplus in Q4’19 (+455 koz) and the particularly large deficit in Q3’20 (-756 koz). These fluctuations reflect the significant impact of mainly pandemic-related changes in 2020 on mine supply and demand from industrial uses and investment.

20年第4季度的鉑金短缺為-170千盎司,而19年第4季度的大量盈餘(+455千盎司)與20年第3季度的特別盈餘(-756千盎司)形成鮮明對比。這些波動反映出2020年主要與大流行有關的變化對礦山供需的工業用途和投資產生了重大影響。

Investment demand

投資需求

During Q4’20, global bar and coin demand more than doubled year-on-year to 60 koz. The strength reflected a much-improved demand in North America, while net sales in Japan and Europe were little changed compared with Q4’19. However, buying was sharply weaker quarter-on-quarter, falling by 38% as a result of Japan swinging from modest net investment during the July to September period to modest net selling in the fourth quarter.

在20年第四季度,全球金條和金幣的需求量同比增長了一倍以上,達到60千盎司。強勁的表現反映出北美需求大大改善,而與19年度第4季度相比,日本和歐洲的淨銷售額變化不大。然而,由於日本從7月至9月的適度淨投資轉為第四季度的適度淨賣出,購買量環比急劇下降,下降了38%。

In North America, the market has effectively recovered from the pandemic-induced shortages which affected Q2’20. In particular, the availability of 1 oz small bars has returned to more normal levels over the past 4-5 months, although retail premiums have often remained above pre-pandemic levels.在北美,市場已有效地從大流行引起的短缺中恢復過來,短缺影響了20年代第二季度。特別是,在過去的4-5個月中,1盎司小條的可用性已恢復到更正常的水平,儘管零售溢價通常仍保持在大流行前的水平之上。

After two strong quarters ETF inflows slowed during October and November but recovered in December to post a net increase in holdings 56% (+26 koz) above Q4’19. At the end of December, ETF holdings were at an all-time high of 3,881 koz. Exchange stocks reduced by around 1 koz and ended the year at a historical high of 657 koz, due to the unusual and unprecedented increase in NYMEX approved warehouse stocks in 2020.

在經歷了兩個強勁的季度之後,ETF的流入量在10月和11月有所放緩,但在12月有所恢復,持有量比19年第4季度淨增加56%(+ 26千盎司)。截至12月底,ETF持有量達到3,881千盎司的歷史新高。由於2020年NYMEX批准的倉庫庫存異常而空前的增加,交易所的庫存減少了約1千盎司,並在年底達到了657千盎司的歷史最高水平。

Chart 4: Platinum Investment, koz

圖4:鉑金投資,單位:千盎司

Shiny黃金白銀交易所

引用來源: 部分擷取 WPIC, PLATINUM QUARTERLY- Q4 2020PLATINUM QUARTERLY- Q4 2020